With RaaS, we gained scale, control over the customer journey, and direct entry into the European market.

Soon

Soon

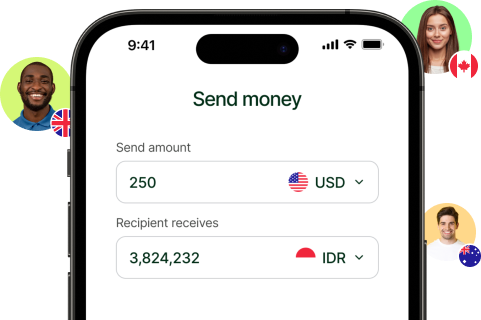

We help individuals and businesses send and receive money securely, quickly, and at competitive rates — with no hidden fees.

(RaaS)

Offer International Transfers Under Your Brand, Without Regulatory Hassles.

Expand your global reach with our payout infrastructure in over 180 countries.

Why Choose Belmoney?

Fast, secure, and tailored international transfers, powered by cutting-edge technology and regulated operations across Europe.

Get same-day transfers on most major currencies.

Collect and pay like a local, hold up to 35 currencies.

Paymint exchange rate are cheaper than bank.

Our security is based on the highest international standards.

Global reach, without borders!

With a presence in over 180 countries, Belmoney enables international transactions in multiple currencies with security and efficiency.

Multi-currency solutions for your business

Licensed and compliant with European regulations

You choose when and how to convert

Belmoney Corporate Card

Coming Soon

We’re crafting a new corporate management experience with a card designed for global businesses. Flexibility, security, and seamless integration with your international operations — all in one card.

Globally Accepted.

Track expenses in real time

Ideal for companies with an international presence

How to get started

Our infrastructure is ready to help you scale from day one.

We support you at every stage of your onboarding with hands-on assistance and comprehensive documentation. From sandbox to production, you’ll never be alone.

It all starts with a strategic meeting, technical analysis, and definition of operational corridors. In this phase, we validate the scope, set up communication channels, and prepare initial access.

With credentials and documentation in hand, we begin the API integration. We configure treasury, MID, Paycross, and other necessary modules to connect your platform to our infrastructure.

We run end-to-end tests in a sandbox environment with financial validations. Once approved, you receive access to the portal and your operation goes live — ready to scale.

Country coverage

Lesotho

Costa Rica

Madagascar

Ecuador

Malawi

El Savador

Mali

Grenada

Mauritania

Guatemala

Honduras

Mauritius

Jamaica

Morocco

Mexico

Mozambique

Nicaragua

Namibia

Niger

Paraguay

Nigeria

Peru

Rwanda

Puerto Rico

Senegal

Suriname

Seychelles

United States

South Africa

Uruguay

Tanzania

Armenia

Togo

Azerbaijan

Tunisia

Zambia

Bahrain

Australia

Bangladesh

Bhutan

New Zealand

Brunei

Samoa

Cambodia

Fiji

China

Papua New Guinea

Hong Kong

Solomon Islands

India

Tonga

Indonesia

Israel

Micronesia

Austria

Japan

Albania

Jordan

Bosnia & Herzegovina

Kazakhstan

Andorra

Kiribati

Belgium

Kuwait

Bulgaria

Kyrgyzstan

Croatia

Laos

Cyprus

Malaysia

Czechia

Maldives

Denmark

Estonia

Mongolia

Finland

Myanmar

France

Nepal

Georgia

Oman

Germany

Philippines

Greece

Qatar

Hungary

Saudi Arabia

Iceland

Singapore

Ireland

South Korea

Italy

Sri Lanka

Taiwan

Latvia

Thailand

Liechtenstein

Türkiye

Lithuania

Turkmenistan

Luxembourg

Tuvalu

Malta

United Arab Emirates

Moldova

Uzbekistan

Monaco

Montenegro

Vietnam

Netherlands

North Macedonia

Norway

Poland

Portugal

Romania

San Marino

Serbia

Algeria

Slovakia

Benin

Slovenia

Spain

Botswana

Sweden

Cameroon

Switzerland

Cape Verde

Chad

Ukraine

Comoros

United Kingdom

Côte d’Ivoire

Vatican City

Djibouti

Argentina

Egypt

Belize

Equatorial Guinea

Bolivia

Brazil

Gabon

Canada

Gambia

Chile

Ghana

Colombia

Kenya

Austria

Albania

Bosnia & Herzegovina

Andorra

Belgium

Bulgaria

Croatia

Cyprus

Czechia

Denmark

Estonia

Finland

France

Georgia

Germany

Greece

Hungary

Iceland

Ireland

Italy

Latvia

Liechtenstein

Lithuania

Luxembourg

Malta

Moldova

Monaco

Montenegro

Netherlands

North Macedonia

Norway

Poland

Portugal

Romania

San Marino

Serbia

Slovakia

Slovenia

Spain

Sweden

Switzerland

Ukraine

United Kingdom

Vatican City

Armenia

Azerbaijan

Bahrain

Bangladesh

Bhutan

Brunei

Cambodia

China

Hong Kong

India

Indonesia

Israel

Japan

Jordan

Kazakhstan

Kiribati

Kuwait

Kyrgyzstan

Laos

Malaysia

Maldives

Mongolia

Myanmar

Nepal

Oman

Philippines

Qatar

Saudi Arabia

Singapore

South Korea

Sri Lanka

Taiwan

Thailand

Türkiye

Turkmenistan

Tuvalu

United Arab Emirates

Uzbekistan

Vietnam

Costa Rica

Ecuador

El Savador

Grenada

Guatemala

Honduras

Jamaica

Mexico

Nicaragua

Paraguay

Peru

Puerto Rico

Suriname

United States

Uruguay

Argentina

Belize

Bolivia

Brazil

Canada

Chile

Colombia

Lesotho

Madagascar

Malawi

Mali

Mauritania

Mauritius

Morocco

Mozambique

Namibia

Niger

Nigeria

Rwanda

Senegal

Seychelles

South Africa

Tanzania

Togo

Tunisia

Zambia

Algeria

Benin

Botswana

Cameroon

Cape Verde

Chad

Comoros

Côte d’Ivoire

Djibouti

Egypt

Equatorial Guinea

Gabon

Gambia

Ghana

Kenya

Australia

New Zealand

Samoa

Fiji

Papua New Guinea

Solomon Islands

Tonga

Micronesia

General FAQ

Find answers to the most common questions about our services and solutions.

Integration is done via API, with full technical support and comprehensive documentation from sandbox to production environment. The entire process is guided by our team, with clear stages for certification, route configuration, and operational testing.

Yes. Belmoney is licensed as a Payment Institution by the National Bank of Belgium and operates under the PSD2 directive, with authorization to provide services throughout the European Union. Our services adhere to strict compliance standards, including KYC, AML, and transactional security.

We serve digital wallets, local banks, remittance companies, payout networks, and financial institutions looking to operate internationally with greater efficiency. Our solutions are designed for businesses aiming to scale quickly, securely, and with minimal regulatory burden.

Ready to get started?